The Of Pvm Accounting

The Of Pvm Accounting

Blog Article

The Of Pvm Accounting

Table of ContentsThe 15-Second Trick For Pvm AccountingNot known Details About Pvm Accounting The Main Principles Of Pvm Accounting 6 Simple Techniques For Pvm AccountingThe Ultimate Guide To Pvm AccountingThe Basic Principles Of Pvm Accounting

Guarantee that the accounting process complies with the law. Apply needed building bookkeeping requirements and treatments to the recording and coverage of building and construction activity.Communicate with various funding companies (i.e. Title Business, Escrow Company) concerning the pay application procedure and needs required for payment. Aid with implementing and maintaining internal economic controls and treatments.

The above declarations are planned to define the general nature and level of work being performed by people assigned to this category. They are not to be taken as an extensive listing of obligations, tasks, and skills called for. Employees may be required to perform obligations beyond their regular duties every now and then, as needed.

The Best Guide To Pvm Accounting

You will certainly assist sustain the Accel group to ensure distribution of effective in a timely manner, on budget, jobs. Accel is looking for a Building Accountant for the Chicago Workplace. The Building Accounting professional carries out a variety of accountancy, insurance coverage conformity, and project administration. Functions both separately and within details departments to preserve economic documents and make sure that all documents are kept current.

Principal duties include, yet are not limited to, managing all accounting features of the firm in a timely and accurate way and giving records and timetables to the firm's CPA Firm in the preparation of all monetary statements. Guarantees that all bookkeeping procedures and functions are handled properly. In charge of all financial records, payroll, banking and everyday procedure of the accountancy feature.

Works with Task Managers to prepare and post all month-to-month invoices. Generates month-to-month Task Cost to Date records and functioning with PMs to integrate with Project Supervisors' budget plans for each task.

Excitement About Pvm Accounting

Effectiveness in Sage 300 Building And Construction and Realty (previously Sage Timberline Workplace) and Procore building monitoring software a plus. https://pvmaccount1ng.bandcamp.com/album/pvm-accounting. Should additionally be efficient in other computer software program systems for the preparation of records, spread sheets and other accountancy evaluation that may be needed by monitoring. Clean-up accounting. Need to possess solid organizational skills and capability to focus on

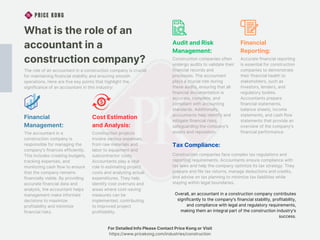

They are the financial custodians who ensure that building and construction projects remain on budget plan, abide by tax page obligation regulations, and preserve monetary openness. Building and construction accounting professionals are not simply number crunchers; they are calculated partners in the building procedure. Their key duty is to take care of the financial aspects of construction jobs, making certain that sources are alloted efficiently and financial risks are minimized.

The Ultimate Guide To Pvm Accounting

By keeping a tight grasp on job funds, accountants aid avoid overspending and economic obstacles. Budgeting is a cornerstone of effective construction jobs, and construction accounting professionals are important in this respect.

Construction accountants are skilled in these laws and ensure that the project conforms with all tax obligation needs. To excel in the function of a building accounting professional, people need a solid instructional structure in accounting and financing.

Additionally, certifications such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Building Industry Financial Specialist (CCIFP) are extremely concerned in the industry. Building and construction tasks commonly include tight target dates, altering policies, and unexpected expenditures.

The Best Guide To Pvm Accounting

Ans: Building accountants develop and monitor spending plans, determining cost-saving opportunities and making certain that the job stays within spending plan. Ans: Yes, building and construction accountants take care of tax conformity for building jobs.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make difficult selections among several financial choices, like bidding on one project over an additional, selecting funding for products or devices, or establishing a job's earnings margin. Construction is an infamously unpredictable industry with a high failing price, slow time to payment, and irregular cash money flow.

Normal manufacturerConstruction company Process-based. Manufacturing involves duplicated processes with easily recognizable costs. Project-based. Manufacturing requires various processes, products, and equipment with differing costs. Dealt with area. Manufacturing or manufacturing occurs in a solitary (or a number of) regulated locations. Decentralized. Each job happens in a brand-new location with differing site conditions and distinct obstacles.

The Buzz on Pvm Accounting

Lasting connections with suppliers alleviate settlements and improve efficiency. Irregular. Constant use various specialty specialists and vendors influences performance and capital. No retainage. Repayment gets here completely or with normal settlements for the complete agreement quantity. Retainage. Some section of settlement might be held back till job conclusion also when the contractor's job is ended up.

While typical producers have the benefit of controlled atmospheres and optimized production procedures, construction business must regularly adjust to each new job. Also somewhat repeatable jobs call for modifications due to website conditions and various other factors.

Report this page